In the United Kingdom, the P11D form is essential for upholding transparency and precision in the taxation of employee benefits and expenses. It serves as a detailed ledger, capturing the diverse array of perks and allowances provided by employers to their workforce, all subject to taxation yet excluded from regular salaries. Let’s delve into the intricacies of the P11D and its pivotal role for both employers and employees.

- Understanding the P11D: The P11D is a statutory form employers utilise to report the monetary value of taxable benefits and expenses bestowed upon employees throughout the tax year. These encompass a broad spectrum, ranging from company cars and health insurance to travel expenses and accommodation allowances. By diligently reporting these benefits, employers ensure compliance with HM Revenue and Customs (HMRC) regulations and facilitate precise tax calculations for employees.

- Exploring Taxable Benefits: Taxable benefits covered by the P11D are diverse, encompassing:

- Company cars and fuel for personal use.

- Private medical or dental insurance.

- Interest-free or low-interest loans.

- Travel and subsistence expenses.

- Employer-provided accommodation.

- Assets transferred to employees at reduced costs.

- Payments made on behalf of employees, such as school fees or childcare.

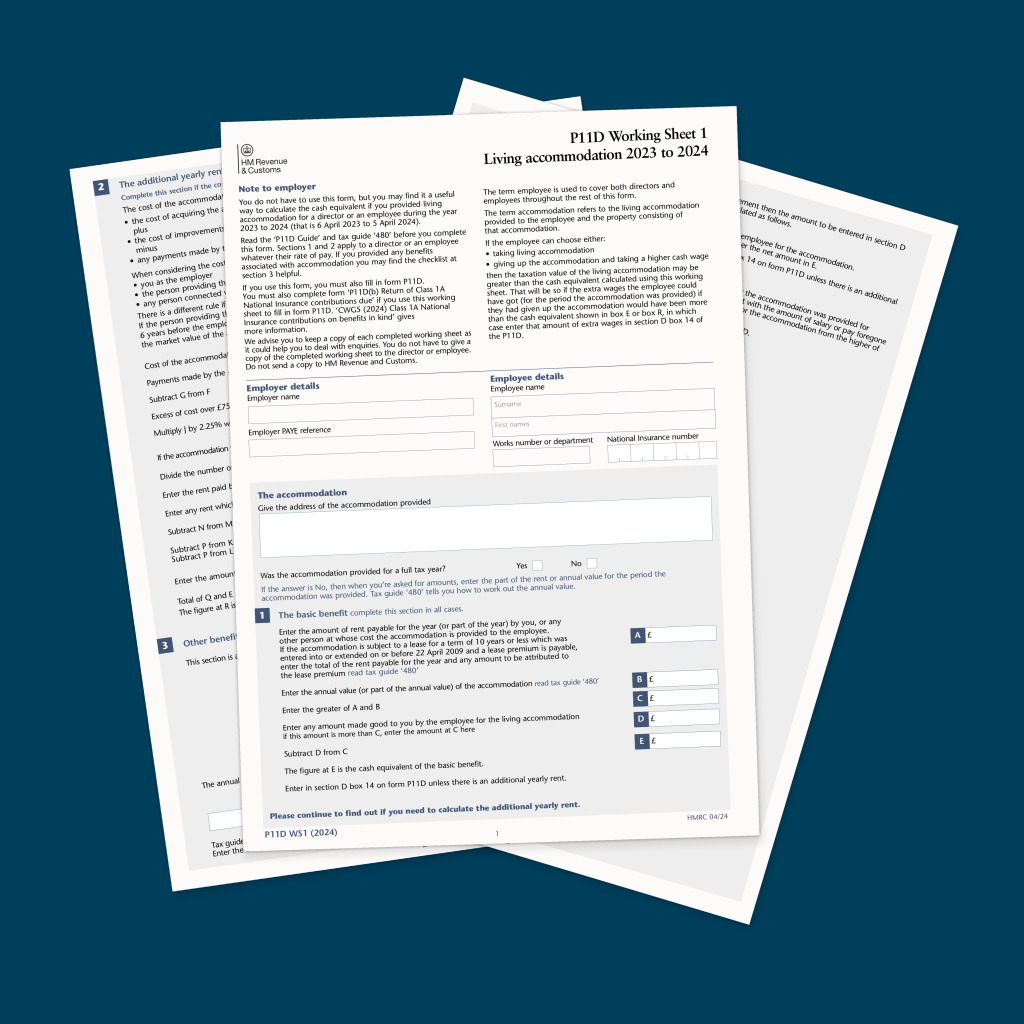

- Employer Responsibilities: Employers are legally obliged to accurately assess and report all taxable benefits and expenses on the P11D form. It entails calculating the cash equivalent value of each benefit as per HMRC guidelines and accounting for any Class 1A National Insurance contributions due. Submission of the P11D to HMRC annually by July 6th and associated payments is mandatory for compliance.

- Considerations for Employees: The information on the P11D is vital for employees to comprehend their total remuneration package and ensure accurate tax payments on benefits received. It also refers to claiming tax relief on certain expenses or deductions. Employees should review their P11D meticulously to verify the accuracy of reported benefits and expenses, seeking clarification from employers or HMRC if needed.

- HMRC Compliance and Penalties: HMRC utilises data from the P11D to scrutinise the accuracy of employees’ tax returns and enforce compliance with tax regulations. Failure to submit the P11D by the deadline or inaccurately reporting benefits may result in financial penalties for employers. Timely and accurate fulfilment of P11D obligations is imperative.

The P11D form is a a critical tool within the UK tax framework, fostering transparency and accountability between employers and employees. Employers uphold compliance with HMRC regulations by accurately documenting taxable benefits and expenses, fostering transparent communication with their workforce. Simultaneously, employees leverage insights from the P11D to navigate tax obligations effectively, fostering trust and transparency in the workplace. Understanding the nuances of the P11D process is pivotal for upholding regulatory compliance and promoting financial responsibility.